Sure, there’s still the glass stratosphere and whatnot. But life sciences VC offers seats on a shuttle that’s taxing the runway now.

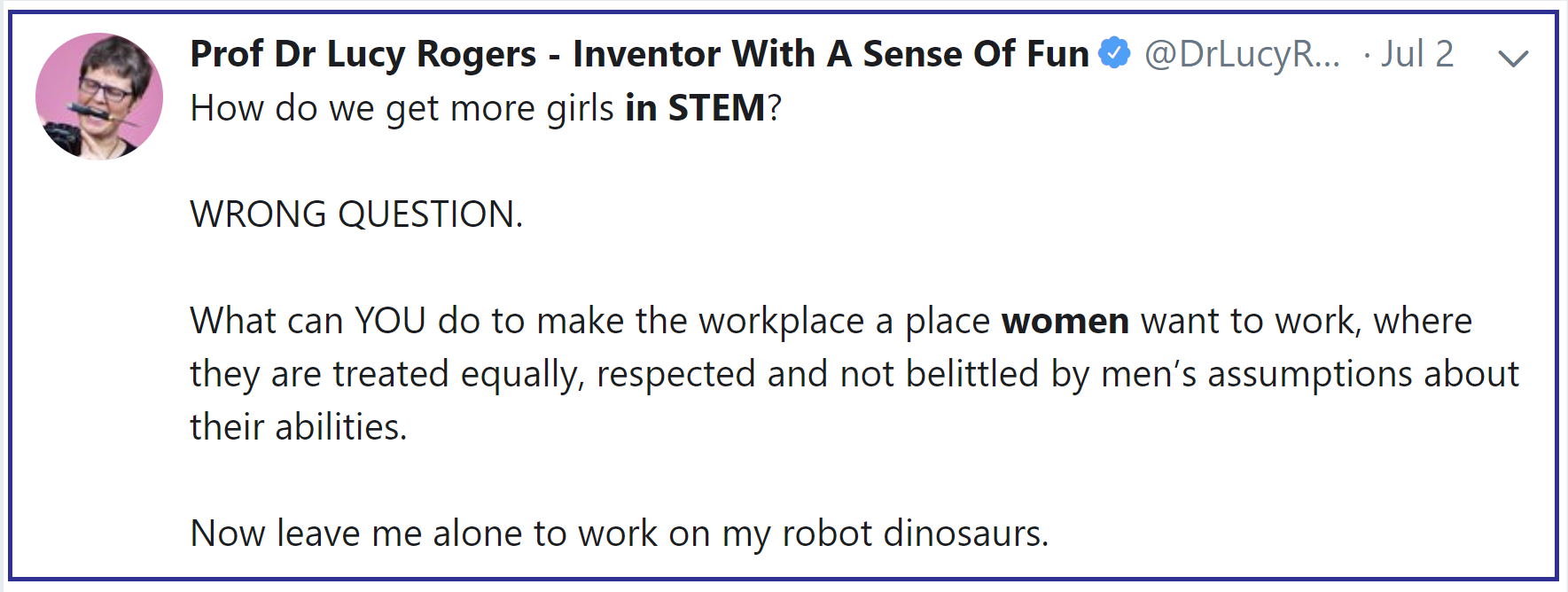

—Dr. Lucy Rogers (Twitter: @DrLucyRogers)

—Dr. Lucy Rogers (Twitter: @DrLucyRogers)

If you’re reading this, you're probably already active in encouraging girls in STEM pursuits. Whether that’s science lab slime kit birthday present for your niece, or through organizations like Boston Area Girls’ STEM Collaborative or Code to Inspire.

But, hey there. Wait. A. Minute. Don’t forget. It all starts with you. Now.

If you want girls studying STEM to mean something, then we need to stop hemorrhaging women in STEM careers.

We have major altitude to cover. But that doesn’t always equate to a burden. In some fields, it’s a ripe opportunity.

Life sciences venture capital is ahead of the diversity curve. And it’s not altruism or D&I PR. It’s ROI and viable business models that change human life for the better.

Smart people with the ears of big investors are saying things that everyone should know. We couldn’t say it better, so here are the highlights with links to the complete articles.

If this resonates, join WESTorg on Tuesday, July 16, 2019, for a panel discussion about venture capital in life sciences while womaning.

And remember what Ros Deegan, CEO of OMass Therapeutics, told us in her WEST leadership interview, biotech needs enterprise generalists and adept business minds. It also needs copywriters and graphic designers and legal teams and you. Get on it.

First, the SMH-reality of our present situation. Check out this 2017 study by Nadya A. Fouad, Wen-Hsin Chang, Min Wan and Romila Singh on reasons why women leave the engineering field (Front. Psychol., 30 June 2017).

“Our results revealed the top three sets of reasons underlying women’s decision to leave the jobs and engineering field were related to:

-

- First, poor and/or inequitable compensation, poor working conditions, inflexible and demanding work environment that made work-family balance difficult;

- Second, unmet achievement needs that reflected a dissatisfaction with effective utilization of their math and science skills

- Third, unmet needs with regard to lack of recognition at work and adequate opportunities for advancement.”

The background and basis of this research are as fascinating as the findings. To be sure, the front lines of VC remain a mixed bag for D&I. But the tides are changing, and life sciences VC is leading the way. This report by the British Business Bank, published less than a month ago in BioScienceToday, has good, albeit it measured, news:

“The life sciences sector, however, is bucking that trend, faring far better than many others when it comes to investing in women-led businesses.

When looking at the distribution of UK VC deals by industry, the Bank’s research found all-female teams in the biotech and pharmaceutical sectors received 10% of funding, compared to 7% for all-male – a marked contrast to industry as a whole.

All-male and all-female teams in companies producing healthcare devices and supplies received and equal proportion of VC funding (5%), while similar teams providing healthcare services and systems also received an equal proportion (2%).”

This is not a UK thing. Locally, MassChallenge partnered with Boston Consulting Group (BCG) to produce this report on women in venture capital (March 2019). You should really check this one out in situ so you can share their infographics on social, or in your own pitch.

“Investments in companies founded or cofounded by women averaged $935,000, which is less than half the average $2.1 million invested in companies founded by male entrepreneurs.

Despite this disparity, startups founded and cofounded by women actually performed better over time, generating 10% more in cumulative revenue over a five-year period: $730,000 compared with $662,000.

In terms of how effectively companies turn a dollar of investment into a dollar of revenue, startups founded and cofounded by women are significantly better financial investments. For every dollar of funding, these startups generated 78 cents, while male-founded startups generated less than half that—just 31 cents.”

These facts aren’t theories or secrets or the stuff of pep talks. Life science venture capital is listening. And acting. MobiHealthNews, an international voice for digital healthcare finance, had this to say on increasing representation in digital health investing:

“‘Venture capital is a really network-driven industry and so it really matters who you spend time with when you are hosting events, who you put on the stage, who you hire to be your partners,’ Megan Zweig, head of research at Rock Health, said. ‘If your venture team and network reflect a certain demographic and maybe it’s overwhelmingly male, that is going to mean that the entrepreneurs that come to you are going to be predominately male, because they are going to see themselves in you and you are going to look at them and equate them to past founders and successes you had.’

Zweig said it is important for VCs to include different voices in events and talking to people with different backgrounds.

‘That actually has to be a really intentional process because that may not be happening organically by virtue of the people you are already surrounding yourself with. So, we really think that wholesale transformation in the area of venture capital is needed to start leveling that play field.’”

Once more, with feeling: ‘Venture capital is a really network-driven industry…[diversity and inclusivity] actually has to be a really intentional process.’

—Megan Zweig, Head of Research, Rock Health (Twitter: @MeganKZweig)

Let’s do this!

Sure, there are miles to go before we crack the glass stratosphere with equity. But life sciences VC offers seats on a shuttle that’s taxi-ing the runway. Founders and co-founders. Board seats. Not just token D&I PR.

As much as we need to girls to study STEM, we need women to stay in STEM careers. Now’s your time! Channel your inner Purl and get it!