Join WEST on September 21, 2021 from 5 – 6:15 p.m. Eastern time for a free financial planning webinar from RBC Wealth Management Advisors Gabrielle Clemens and Lisa M. Austin. Gabrielle and Lisa will draw on their combined experience in estate planning, family law, and sustainable investing to walk attendees through the basics of planning for an unpredictable future, focusing especially on the risks of cognitive decline. They'll discuss how to approach and understand options for structuring finances to answer the question, "What if something happens?"

Free Financial Planning Webinar: Preparing for the Unexpected

Topics: Women, Financial Planning, Wealth Management, Transitions, Work Life Balance, Life, Resilience, Upcoming Events, Relationships, Discussion, Resources, Solutions, Balance, Tools, Self-Awareness, Decision Making, Support, Impact, Risk, Learn, #WESTevent, #WESTorg, Investing

Introducing WEST's 2021-2022 Executive Board Team

Having just concluded WEST's fiscal year, we would like to thank our 2020-2021 Board Officers: Meena Subramanyam, President; Etta Jacobs, Vice President; Meredith Fisher, Clerk; Eleanor Howe, Treasurer; and Chesley Chen, Advisor & previous Co-Chair. Meredith and Chesley completed their board terms in June and we welcomed a few new Board Members to the team in July. Learn more about WEST's Board of Directors.

Topics: Leadership, Women, Financial Planning, Wealth Management, Transitions, Career, Community, Work Life Balance, Resilience, Success, Women in STEM, Discount, Upcoming Events, Professional, Discussion, Financial, Resources, Interactive, Lessons Learned, Tools, Career Path, Developing Your Skills, Self-Awareness, Decision Making, Confidence, Strengths, Values, Impact, Career Development, Empowerment, Advice, Learn, #WESTorg, Gender Parity, Grow, goals, Purpose

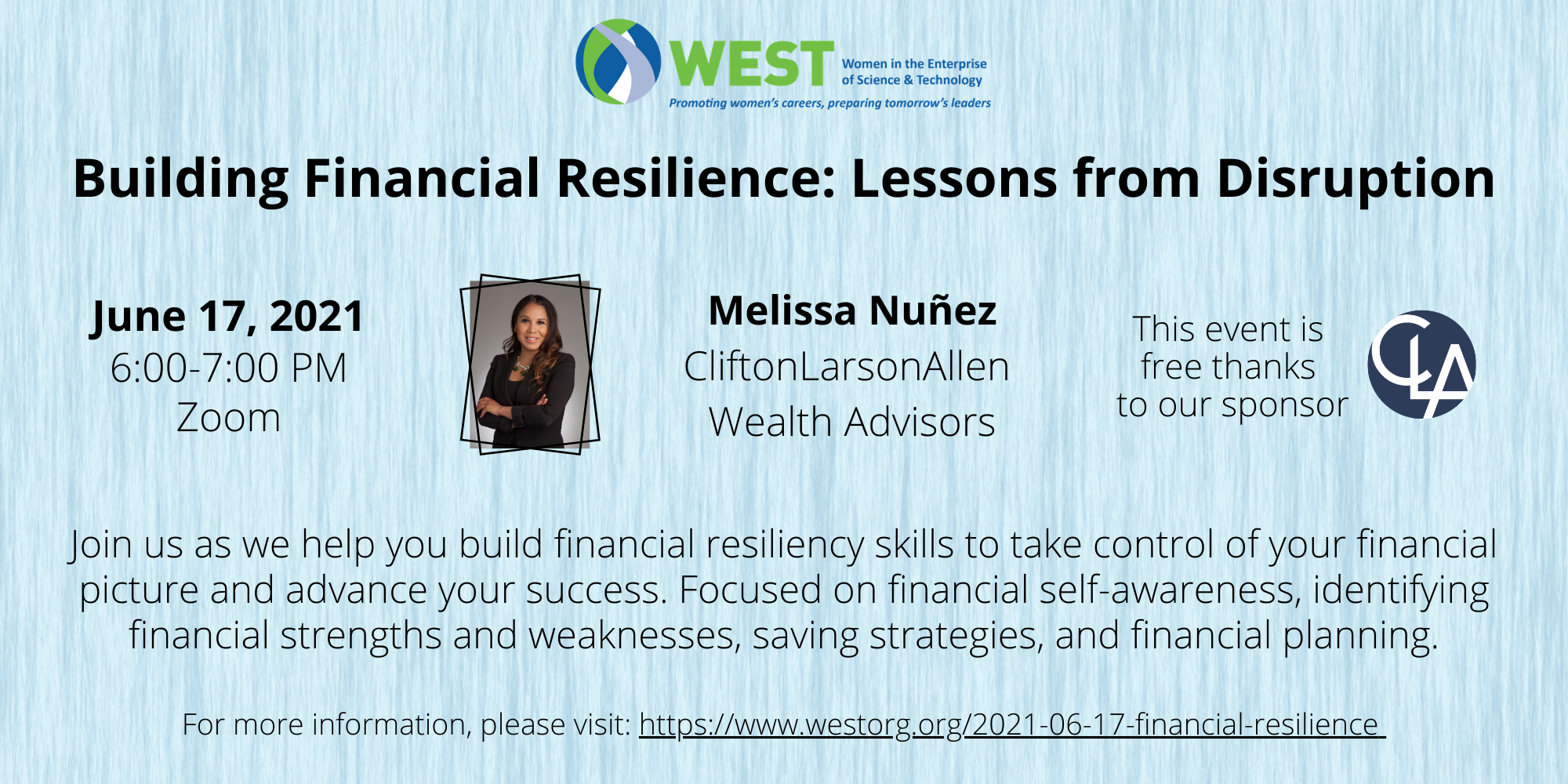

Building Financial Resiliency: Lessons from Disruption

Join WEST on June 17, 2021 to hear from Melissa Nuñez, a Certified Financial Planner TM and Accredited Investment Fiduciary®, as she shares strategies for building financial resiliency and maintaining level financial footing, especially in the face of the unexpected. Melissa will help us reflect on the challenges and changes we have faced during the COVID-19 pandemic and help us plan to meet future financial goals, from paying off debt to buying a home to saving for retirement. Tickets for this event are free thanks to our sponsor, CliftonLarsonAllen.

Topics: Women, Financial Planning, Wealth Management, Transitions, Career, Community, Work Life Balance, Resilience, Success, Women in STEM, Discount, Upcoming Events, Professional, Discussion, Financial, Resources, Interactive, Lessons Learned, Tools, Career Path, Developing Your Skills, Self-Awareness, Decision Making, Confidence, Strengths, Values, Impact, Career Development, Empowerment, Advice, Learn, #WESTevent, #WESTorg, Gender Parity, Grow, goals, Purpose

What’s in your portfolio? Join us on Thursday, 4/29 at 5:30 p.m. EST to hear experienced financial advisors explore strategies for aligning your investment portfolio with your personal values through impact investing.

In this interactive discussion, we will hear from Judith Reed, a financial advisor at Morgan Stanley who specializes in helping women in the Life Sciences industry create financial plans for themselves and their families, and William Gambardella, Executive Director of the Morgan Stanley Wealth Management Global Investment Office (GIO).

Topics: Women, Financial Planning, Wealth Management, Career, Success, Women in STEM, Upcoming Events, Discussion, Financial, Interactive, Change, Values, Impact, Learn, #WESTevent, #WESTorg, Gender Parity, Sustainability, Investing

You plan your weekend; why not your retirement?

You’d never leave your smartphone on the factory settings, so why set-and-forget your retirement?

For many of us, the effort we put into planning our next vacation far exceeds the attention we give to retirement planning. You waded through so many forms when you started that new job. Retirement stuff got the ‘set-and-forget’ treatment.

Topics: Events, Financial Planning, Wealth Management, Career, Women in STEM, Financial, Economics, Compensation, Own It, Empowerment, Women in Business, Be Fearless, Be Brave

Tips for Maximizing the Value of Your Compensation and Benefits Package

In today’s competitive market for talent, many employers are offering attractive compensation and benefits packages. In addition to salary, bonus, and equity compensation, “softer” benefits like expanded maternity leave, flexible schedules, and wellness programs are becoming more common.

Topics: Events, Financial Planning, Wealth Management, Career, Cambridge

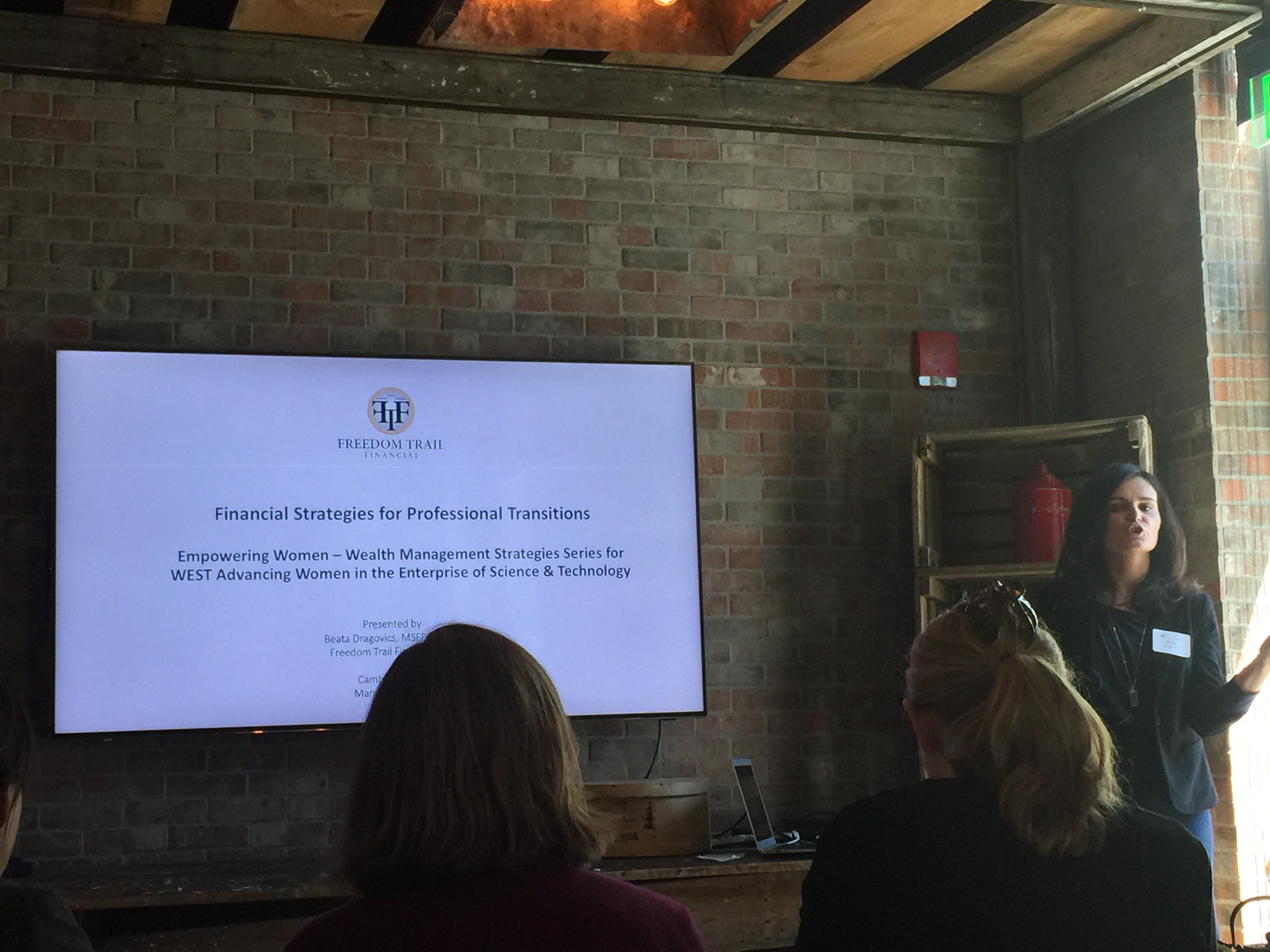

Negotiating Your Compensation Package: Financial Strategies for Professional Transitions

Are you planning a career change? Thinking of jumping to a competitor? Has a recruiter contacted you about a new job opportunity? If you answered yes to any of these questions, you will need to have a strategy in place to negotiate the best possible compensation package for yourself.

Topics: Events, Women, Financial Planning, Wealth Management, Transitions, Career, negotiation

Tips for Incorporating Equity Compensation into Your Overall Financial Plan

Today, more women are advancing to senior positions within the life sciences industry. Along with added responsibilities, senior executives usually receive stock options or other forms of equity compensation as part of their compensation packages. In this lunch program, financial advisor Beata Dragovics provides an overview of the various forms of equity compensation, along with current compensation trends within the life sciences industry. Attendees will learn how to optimize their equity compensation packages, with a particular focus on managing concentrated wealth. Other topics include the tax ramifications of exercising stock options, along with tactics for treating equity compensation as a vital piece of your overall financial plan.

Topics: Events, Financial Planning, Wealth Management

5 Mistakes to Avoid When it Comes to Financial Planning

Topics: Events, Women, Financial Planning, Wealth Management

.png)